Tokenomics

The native token of the platform, MatchUp Token (MATCH), is used solely as a means of participation and engagement within the platform. $MATCH is not a security, financial instrument, or investment product. Instead, it is a utility token designed to facilitate participation in voting campaigns.

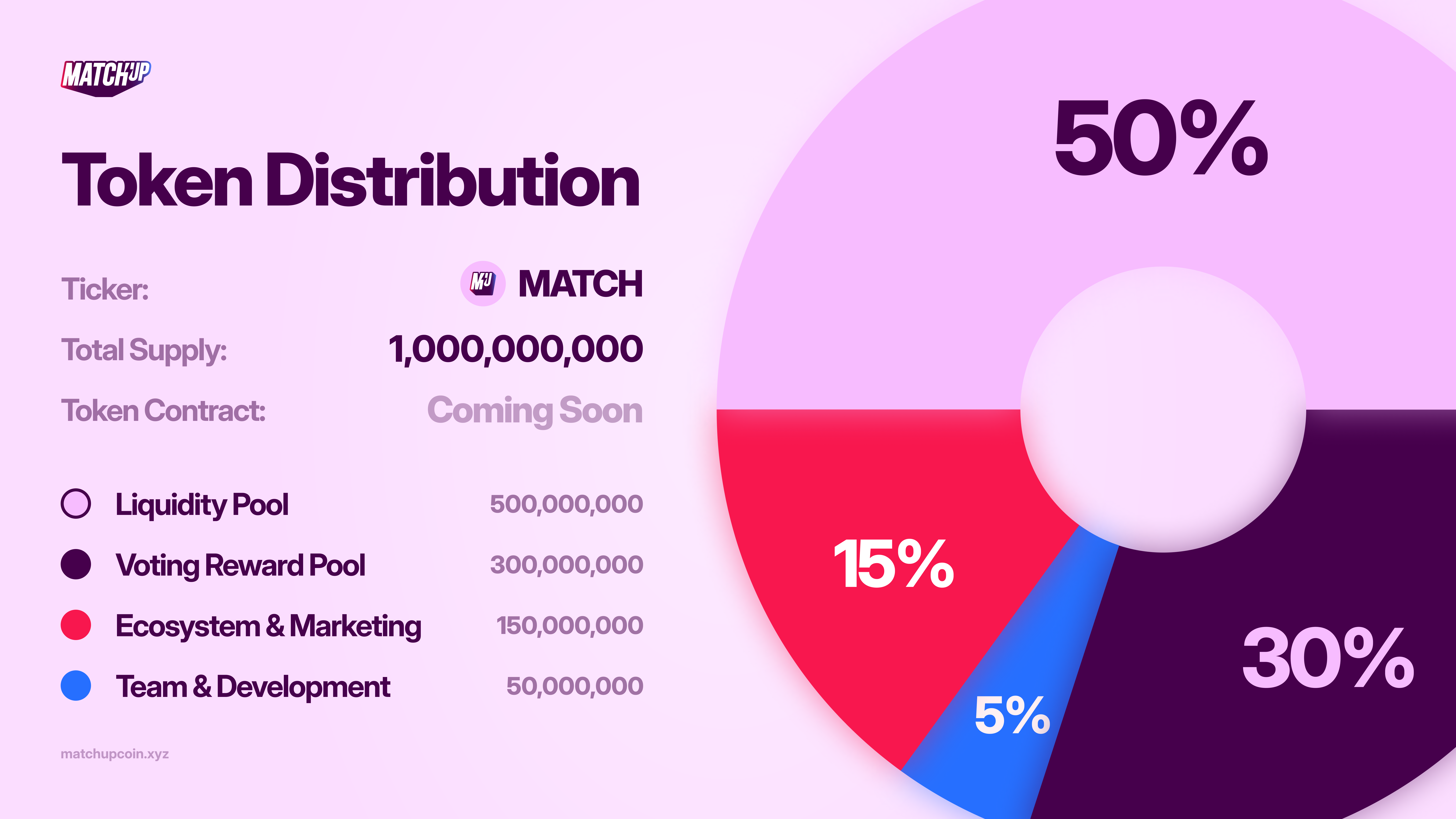

Token Supply: 1,000,000,000 $MATCH (Fixed)

Token Allocation

Liquidity Pool (LP)

50% (500 million $MATCH) – Used to ensure deep liquidity and reduce price volatility across decentralized exchanges.

Voting Rewards Pool

30% (300 million $MATCH) – Allocated for rewarding users who participate in voting campaigns and maintain a high balance of the token.

Ecosystem, Marketing and Community Growth

15% (150 million $MATCH) – Reserved for community-building efforts, partnerships, possible CEX listings and promotional campaigns to drive user growth.

Team and Development

5% (50 million $MATCH) – Allocated for core team members, developers, and advisors to ensure long-term development and success.

Transaction Tax Mechanism

To ensure long-term sustainability and fund operational costs, MatchUp will implement a 1.5% tax fee on all buy and sell transactions of the $MATCH token. This transaction fee will help maintain the platform without requiring additional revenue models or compromising user experience. The tax will be used for two primary purposes:

- Operational Costs: A portion of the tax will be allocated to cover ongoing platform maintenance, development, and operational expenses, ensuring MatchUp remains functional and secure.

- Potential Buybacks: A portion of the collected tax will be reserved for token buybacks. These buybacks will be executed strategically to support the token’s value, maintain healthy liquidity, and foster price stability, benefiting the entire community.

Key Points about the transaction tax:

1.5% Tax Fee: The tax is applied on all buy and sell transactions of the $MATCH token across decentralized exchanges. No Increase in Tax: The tax fee will never exceed 1.5%. This ensures that transaction costs remain predictable and reasonable for the community.

Potential Reduction:

Over time, as the platform matures and generates more self-sustaining revenue, the tax rate may be reduced in favor of a more efficient and sustainable model.

Transparency:

All funds collected via the transaction tax will be transparent and trackable on-chain, ensuring full accountability.

How the 1.5% tax fee is distributed:

- 50% for Operational Costs: Half of the tax will be directed toward funding the day-to-day running of the platform, including infrastructure costs, ongoing development, and security.

- 50% for Token Buybacks: The remaining portion will be allocated for potential buybacks. This helps maintain the health of the liquidity pool, reduce supply, and potentially stabilize the token price over time.

Long-Term vision for the transaction tax:

As the platform grows and additional revenue streams develop, the 1.5% tax may be lowered gradually. The ultimate goal is to rely less on transaction taxes and more on sustainable revenue sources such as platform usage fees, partnerships, and community-driven growth. Reducing the tax over time will benefit holders and users by encouraging more trading and liquidity flow while ensuring the platform remains economically viable in the long run.

This tax structure ensures that the MatchUp ecosystem remains sustainable and that the platform can continue to operate and innovate without requiring external funding or compromising user benefits.